The Atlantic

Renting Is Terrible. Owning Is Worse.

A third option is necessary: a way to rent without making someone else rich.

By Shane Phillips MARCH 11, 2021

Excerpts

H. Armstrong Roberts / Getty / The Atlantic

America conceives of itself as an “ownership society.” Nearly two-thirds of U.S. households own their home, and the idea of renting is inseparable from ownership in the U.S. context. Renting is given meaning by its relationship to ownership—it’s how you live if you can’t afford, or aren’t yet ready, to own. America treats renting as it has treated the minimum wage for the past several decades: unworthy of serious concern, just a phase in young people’s lives, and a long-term outcome only for those unwilling to pull themselves up by their bootstraps. This perspective is a big part of why renters enjoy so few protections, and why the U.S. showers roughly $150 billion on homeowners each year but only a fraction of that on renters, despite renters having about half the median household income of owners.

The housing situation is only getting worse—more expensive, more inequitable, more precarious. As prices have continued their climb in the country’s most economically dynamic regions, it’s no longer feasible for working-class residents to seek out the best opportunities there. Instead, younger and lower-income residents are being pushed out to places where jobs are less plentiful and lucrative, but where housing, at least, is relatively affordable. Largely as a consequence of housing prices, Generation X held less than half as much wealth in 2019 as Baby Boomers of the same age did two decades earlier, and Millennials are on course to hold even less.

Something has gone catastrophically wrong, and the problem won’t be solved by doubling down on homeownership; we’ve seen where that leads. But our current model of renting—a lifetime of uncertainty only to make someone else rich—won’t do the job either. We need something new, an innovation on par with the government’s development of 30-year mortgages nearly a century ago. We need a housing option that combines the accessibility, flexibility, and limited risk of renting with some of the stability and wealth-generating potential of homeownership.

Renting carries certain intrinsic advantages over ownership, for individuals as well as society. One is flexibility, and the access to opportunity that accompanies it.

Renting offers diversification of risk. Renters are able to invest their resources in a wider array of assets, and they aren’t stuck holding the bag if their regional economy dries up and home prices fall. Mutual funds would not be seen as a worthy investment if they had a 10 percent chance of permanently losing much of their value at some unspecified date, yet that’s very similar to how our housing-as-retirement-vehicle system currently works. The investments renters might make, moreover—stocks, bonds, mutual funds, etc.—support the growth and innovation that strengthen the economy, whereas buying a home takes that money out of circulation.

Most important, more renting may improve housing politics and make the nation’s affordability crisis easier to solve. We need to build more homes in order to stabilize home prices, yet stabilizing home prices runs counter to the financial interests of most homeowners. In California, the epicenter of the crisis, 75 percent of renters support building more homes in their community; only 51 percent of the state’s homeowners support this goal. A research paper by the political scientists William Marble and Clayton Nall similarly found that support for building new apartments is consistently higher among renters than homeowners; it’s higher even among conservative renters than liberal homeowners. (Conservatives overall are less supportive of new multifamily housing than liberals are.) The effects of this opposition extend beyond affordability. Pushing new housing into remote places that offer poor access to good jobs and schools contributes little to economic growth and productivity, increases emissions of greenhouse gases and other harmful pollutants, and destroys agricultural and undeveloped lands.

By themselves, these are rather abstract reasons for promoting more renting. They won’t be persuasive unless we also address renting’s most obvious disadvantage: the lack of wealth-building potential.

In some u.s. cities, middle-class households are paying $30,000 in annual rent and have nothing to show for it but the prospect of paying $31,000 next year and $32,000 the year after that. This is why people buy suburban homes even when they’d prefer to stay in the city. Spending so much on a rental feels wasteful—irresponsible, even—when you could pay a similar price on a mortgage, at a constant level for the next 30 years, while also building substantial wealth. America’s challenge is to create comparable opportunities in cities, and to make them accessible to people who can’t save $100,000 or more for a down payment.

A public-ownership rental option might solve this problem, at least in part. The foundation of the program would be quite simple: public ownership of housing, acquired or built with government loans—though run by local for-profit or nonprofit property managers—and rented at market prices. No saving for a down payment (or being given one by family) and no qualifying for a mortgage. The only requirements for participation in the public-ownership option would be (1) move in, and (2) pay rent.

As the loans were paid down, the equity would accrue to the tenants, minus the cost of operating and maintaining the building, administrative costs, and so on. Unlike rent-to-own programs, however, this option would never require that the tenant take out a mortgage. A renter would never truly “own” her unit. But she would claim a stake in the public portfolio of properties and be able to draw on that asset, perhaps in the form of monthly payments after a few years of renting, or larger dividends later in life, much like Social Security. The benefit could be transferred to any publicly owned apartment, allowing tenants to build wealth without being locked in place. After 35 or 40 years, a tenant might no longer owe any rent at all. There are many more things to say about the logistical details, and I have said them elsewhere, but that’s the core of the idea.

Public ownership would give younger households the opportunity to begin generating wealth immediately, from the minute they form their first household—a leap forward for both racial and generational equity. People who have spent the past five or 10 years renting an apartment in high-cost cities such as New York, Los Angeles, and Seattle will understand the clear benefits. The program is simple, accessible, and fair.

Public ownership can appeal to the middle class, a quality missing from virtually every other government housing program. Existing programs tend to focus either on the poor, as with affordable-housing construction and housing vouchers, or on the rich, as with mortgage-interest tax deductions and capital-gains exclusions. Renting in a public-ownership building would be an option for the large number of middle-income individuals who lack the resources or the immediate desire to become homeowners. And the system could be managed without subsidies, avoiding tension with programs that assist low-income households. Low-interest government loans would be sufficient to finance the program.

Homeownership isn’t going anywhere. Ending it shouldn’t be America’s goal, and trying to would be silly. But mass homeownership shouldn’t be our societal objective, either—it fails too many people and perpetuates too many historical inequities to remain the sole symbol of success in the housing market. We deserve better than the two flawed choices available to us: unstable and unprosperous renting or risky, inaccessible, and inequitable private ownership. We deserve another option, and public ownership could be it.

Shane Phillips manages the Randall Lewis Housing Initiative for the UCLA Lewis Center for Regional Policy Studies and is the author of The Affordable City: Strategies for Putting Housing Within Reach (And Keeping It There).

_______________________________________

Comment:

Shane Phillips is onto something; he has laid out his case clearly and cogently. Here are four important points he made that can lead to a more focused solution, followed by responses to each:

Younger and lower-income residents are being pushed out to places where jobs are less plentiful and lucrative, but where housing is relatively affordable. Pushing new housing into remote places increases emissions of greenhouse gases and other harmful pollutants, and destroys agricultural and undeveloped lands.

Paradoxically, we are seeing among the younger generation the embracing of an urban lifestyle, and simultaneously the centrifugal pull of the suburbs. The problem is that even if young households want to centralize, they can’t afford it. The quest for affordable housing is the driving force behind suburban and exurban location choice.

Eventually, this flight from cities will become a futile pursuit. Land prices will rise. Increased transportation costs will offset lower price homes. Home builders will sell their products at the highest price the market will bear. Building single family homes in exurbia is not going to provide the quantity and affordability that meets the demand market. Moreover, it leads to a land and energy-intensive development pattern, adding to urban sprawl and a car-centric lifestyle.

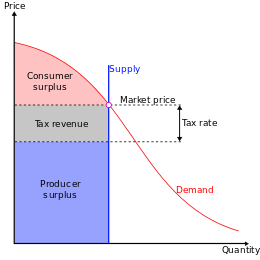

Mass homeownership fails too many people and perpetuates too many historical inequities. Stabilizing home prices runs counter to the financial interests of most homeowners. This is how our housing-as-retirement-vehicle system currently works:

Homeowners are reaping billions of dollars in equity a year, not from their houses, but from the land upon which the houses sit. Expectation of equity build-up is propelling land speculation, which is what is driving up housing prices. A widespread notion is that owners expect to sell their property to garner wealth for their families. Housing, rather than regarded primarily as shelter, has become a commodity. Ultimately, no one benefits from this scenario, especially newly forming households or those near the bottom of the income scale, and as long as existing homeowners seek replacement housing.

Existing programs tend to focus either on the poor, as with affordable-housing construction and housing vouchers, or on the rich, as with mortgage-interest tax deductions and capital-gains exclusions.

One such program, the Low-Income Housing Tax Credit is supported by the federal government. Property owner-investors receive a tax break in exchange for reserving a share of their units for low-income renters. But LIHTC comes with a built-in expiration, from 10 to 60 years. When the date comes, owners are allowed to raise the rates for those low-income units up to market rate.

The LIHTC program was set up as a tax benefit to investors. The low income tenants have become dispensable, left in an insecure situation by no shortcoming of their own. What happens when thousands of affordable units are converted to market rate by their owners? It’s likely that taxpayers will pick up the tab if voters agree to paying for perpetual public subsidies. Otherwise, low income tenants are left out in the cold.

A public-ownership rental option might solve this problem, at least in part. Acquired or built with government loans—run by local for-profit or nonprofit property managers—and rented at market prices. As loans were paid down, the equity would accrue to the tenants.

Shane Phillip’s basic premise is correct – there is really only one way to permanently halt the growing affordable housing crisis. That is to remove a substantial share of the existing housing stock from the private speculative market. The public-owned rental option is a viable model for the good reasons stated. However, there will always be some who will prefer to become homeowners. There are advantages too. A widespread perception is that ownership contributes to neighborhood stability. Owners, cognizant of resale value, are likely to be more diligent about structural upkeep, possibly extending the economic life of buildings.

The ownership model that achieves the similar goals of freedom, flexibility, and predictability is the community land trust, a prime example of social housing. Our current private housing market, which promotes housing as a tool for wealth creation, leaves many families behind. Community land trusts offer a solution to that problem by putting housing under the control of the residents. Prospective homeowners are able to enter long-term renewable leases at an affordable rate. The CLT retains the title to the land while an income qualified homebuyer acquires title to the structure. Upon selling, homeowners earn a portion of the increased property value attributed to improvements, while the trust keeps the land value remainder, thereby preserving affordability for future low-to-moderate income families. Perpetual ownership of land titles by a non-profit corporation offers a more sustainable form of tenancy.

The main barrier restraining high volumes of construction is the lack of funding. Community land trusts rely on external funding to start up and produce homes. Local governments will have to commit to providing seed money, for example, providing low-interest loans to tenant associations for building purchases. Cities with surplus public land can adopt land banking that directly transfers property to CLTs. They could also transfer tax-delinquent repossessed properties.

As properties developed under LIHTC subject to affordability restrictions approach their expiration date, owners may convert them to market rate housing. A first step toward preventing evictions that could follow is a “tenant opportunity to purchase”, requiring landlords to give tenants advance notice and the right of first refusal on a property sale. This measure would be much more effective if legal rights were extended to include not only rent restricted projects but all rental properties up for sale. This would keep available sites out of the reach of speculative investors. By holding perpetual ownership of land titles the land trust limits the growth of land values beneath the buildings.

In conclusion, both rental and ownership options under public/non-profit ownership offer a viable path to housing affordability.

Tom Gihring, Research Director

Common Ground – OR/WA

1 Comment

Pingbacks

-

[…] Renting Is Terrible. Owning Is Worse. […]

[…] Renting Is Terrible. Owning Is Worse. […]