GHOST HOUSES VANISH WHEN INCENTIVE TAXATION APPEARS

Common Ground OR/WA Spotlights Three Cases of Property Neglect, and how a Land Value Tax Could Incentivize Redevelopment

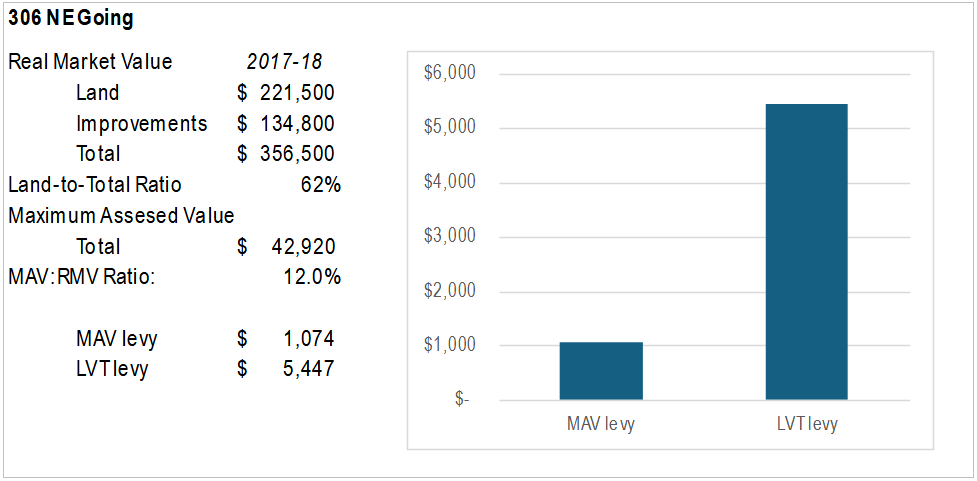

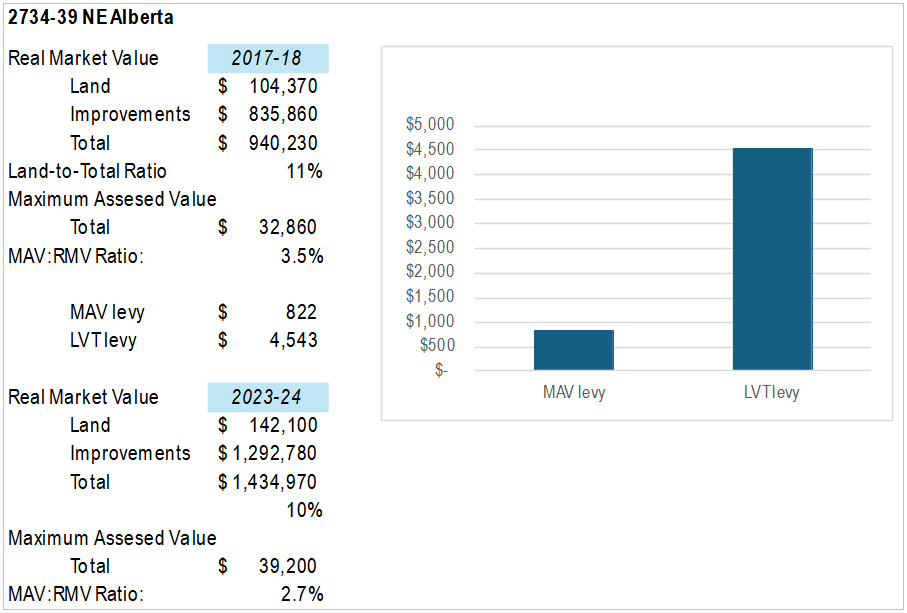

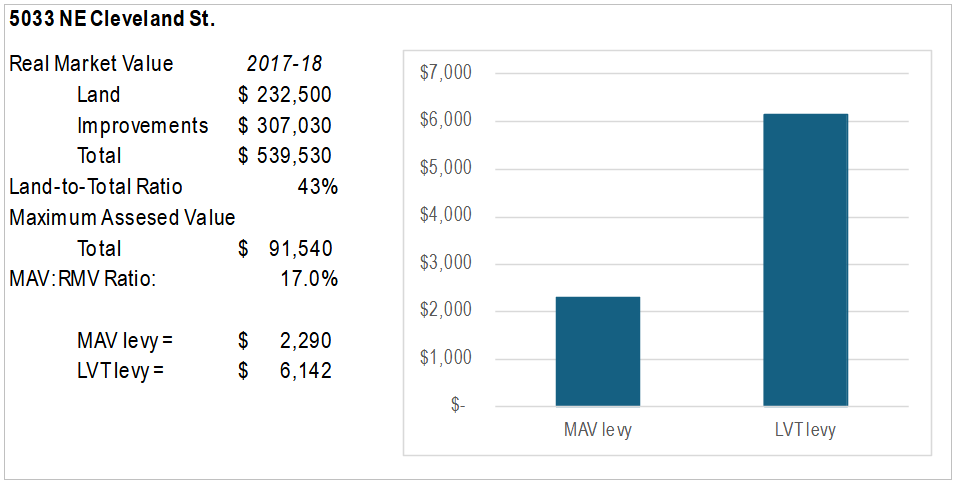

Oregon’s current convoluted property tax system is a product of the Oregon Tax Revolt, which started in 1990 with the passage of Measure 5, followed by Measure 50. M-50 limits all property owners’ assessed value from increasing more than 3% per year. Tax rates are applied to the annual maximum assessed value (MAV) of each property. Since 1993 when M-50 took effect, the gap between taxable values and real market values (RMV) gradually widened. By 2017, the gap, measured as the MAV:RMV ratio reached 39% for the total of all assessed property value in Multnomah County.

In 2017 Common Ground OR/WA commissioned the Northwest Economic Research Center at Portland State University to conduct a study of the tax burden effects of M-50 in two Portland communities: Inner Northeast (INE) and Outer Southeast (OSE). NERC researchers found that the MAV:RMV gap in the rapidly gentrifying INE community had reached a point where average MAV assessments were only 29% of RMV assessments. This has resulted in much lower property taxes than for properties in slower growth OSE which shows a narrower gap (55%).

The most persistent financial impediment to housing production is the extremely low property tax on vacant and underutilized sites. This encourages owners to hold onto their properties while land values around them continue to rise, then later to capture the windfall gain (unearned equity) when it’s advantageous to sell.

Under Oregon’s limited assessment equal rate taxation, owners have no financial incentive to improve property because a higher tax liability will result from taxing the building improvements. The single-rate M-50 tax system encourages land speculation, shoddy construction, and property underutilization.

A robust solution to this persistent problem is a reform of Oregon’s property tax regime by replacing it with a land value tax (LVT). The split-rate version of this system applies a high tax rate to each property’s land assessment and a low rate to improvements. In this way LVT provides landowners both a carrot and a stick.

LVT’s carrot comes in the form of the benefit the tax system provides: if landowners improve the buildings on their land or tear-down and replace a dilapidated building, the value of those new improvements will be taxed at a much lower effective rate. LVT’s stick is that if a landowner holds land in an unproductive fashion and fails to make improvements, it will cost much more than under a single-rate system. As a result, it may become too costly to hold onto vacant or underutilized sites, depleting the cash reserves from the holdout owner.

Observant reporters at Willamette Week regularly scout the city of Portland “chasing ghosts” – vacant or neglected properties for readers to ponder. The unspoken hint is that something should be done about this problem. Well, why not use an “incentive tax” to motivate reluctant owners to improve or sell?

We selected three from the collection of ghost parcels that are located in NERC’s LVT study area – Inner Northeast Portland. The study’s 2017-18 database readily provides the figures we can use to illustrate the financial incentives of a land-based tax, comparing the results with the current tax system. It appears these selected sites have not substantially changed over the past 5 years.

For each ghost property, we include: an excerpt from the WW article, the RMV and MAV values; the MAV:RMV ratio; the conventional and LVT levy amounts. See the end notes for tax rates used.

Let’s take a look…

WILLAMETTE WEEK February 14, 2024 By Nigel Jaquiss

A Prime Corner Lot in the King Neighborhood Houses Rats and Raccoons

It’s been empty for 15 years, even as the property market has boomed all around Portland.

306 NE Going (Nigel Jaquiss)

ADDRESS: 306 NE Going St.

YEAR BUILT: 1911

INTERNAL SPACE: 1,482 sq.ft.

LOT SIZE: 3,935 sq.ft.

MARKET VALUE: $465,930

HOW LONG EMPTY: 15 years

It’s an unkind irony, then, that Ariel Werbicki, who is still renting, lives right next door to a home that has stood vacant since 2008. Werbicki says it’s both perplexing and frustrating to see the adjacent home at 306 NE Going St. occupied by only rats, raccoons, and the occasional squatter.

“It’s a beautiful corner lot right on a bike lane,” she says. “You can walk to everything from here: the dog park, coffee, shopping…it’s got everything.” Everything except a tenant. Jeff Gersh, who owns the home Werbicki rents, says the Going Street house has been empty since 2008, when he bought the property next door.

Records show that Patricia Giroux, a Portland resident, purchased the now-vacant property in July 2008 for $100,000. The first of five nuisance complaints to the city about the property came in 2009, records show, and continued right up until the end of last year, when inspectors forced Giroux to deal with a chimney that was peeling away from the south side of the house.

Gersh says he’s had sporadic contact with Giroux over the years, mostly to alert her to problems. He once asked her if she’d like to sell, as did one of his former tenants, but those entreaties went nowhere. “When she bought it, it was a sweet little house,” Gersh recalls. “Now, I don’t think you could save it. Probably a job for a bulldozer.”

In the meantime, Giroux, who didn’t respond to phone and text messages, pays the minuscule property taxes on the house—$1,357 last year—and, presumably, waits for developments more positive than a collapsing chimney.

Comment:

Here the MAV taxable value is a fraction (12%) of the true market value, accounting for the low tax levy. Given the condition of this long vacant single family structure, it’s suprising that the appraised value has increased by 30% over the past six years, although most of that increase is likely in the value of the land, which in this case comprises most of the total value. The LVT levy increases the conventional MAV levy by five times. This may cause Ms. Giroux to reconsider the delay and sell soon to a developer who would redevelop the lot.

WILLAMETTE WEEK December 6, 2023 by Anthony Effinger

The owner of a dilapidated charmer on Alberta Street has run out of time.

A building on the corner of Northeast Alberta Street and 28th Avenue started dropping bricks onto the sidewalk more than a year ago. (Anthony Effinger)

ADDRESS: 2734-2738 NE Alberta St.

YEAR BUILT: 1908

INTERNAL SPACE: 4,748 sq.ft.

LOT AREA: 2,500 sq.ft.

MARKET VALUE: $1.5 million

HOW LONG EMPTY: 9 years

It’s been more than a year since the stately but decrepit two-story building at NE 28th Ave. and Alberta St. started dropping bricks onto the sidewalk. Yet the property remains fenced, forcing people to walk in the street on the south side of busy Alberta. That’s because the owner, a trust controlled by Erzsebet Eppley, hasn’t finished repairs that would make the building – and the block safe again.

Eppley, reached by phone, says that’s mostly because there aren’t enough contractors to do the work. The city, it appears, has finally lost patience with Eppley. Earlier this year, it issued an order that allowed Eppley to repair or demolish the building in a timely manner. Eppley chose to repair it and began working with engineers and contractors. “If the property owner can demolish the building, they will avoid additional civil penalties.” Little has happened since Eppley took down the unstable bricks along the east façade. Nothing has been repaired.

Comment:

Here’s a building that is in decrepit condition, yet the real market value assessment on the structure was boosted by 55% over the past 6 years, compared to a land assessment increase of 36 percent. If the building continues to deteriorate how can its RMV increase – at all? That’s one for the county assessor’s office. And look at the enormous gap between growing RMVs and lagging MAVs – it keeps increasing. By now the taxable value is only 2.7% of the true value of this property.

So the city is losing patience. Compare the “stick” approach of issuing code violations time after time with the “carrot and stick” approach of an incentive property tax. Ms. Eppley’s miniscule tax bill would increase by 550% to $4,543 for the 2018 tax year. Forget the civil penalties, the high tax burden might be what is needed to sell fast. If a new owner redevelops the site, they get the carrot.

WILLAMETTE WEEK January 24, 2024 By Nigel Jaquiss

A Classic Home in the Humboldt Neighborhood Fades Away

A bee infestation was one of the causes of complaint for neighbors of the long-vacant property.

5033 NE Cleveland St. – Humboldt (Nigel Jaquiss)

ADDRESS: 5033 NE Cleveland St. – Humboldt

YEAR BUILT: 1911

INTERNAL SPACE: 2,360 sq.ft.

LOT AREA: 5,000 sq.ft.

MARKET VALUE: $533,060

HOW LONG EMPTY: 30-plus years

A lot has changed in the Humboldt neighborhood over the past 30 years. The tide of gentrification rumbled through inner Northeast Portland and its stock of early 20th century homes. One thing that hasn’t changed: the vacancy at one the neighborhood’s most venerable homes, less than a block from the intersection of North Williams Avenue and Northeast Alberta Street.

For many years, the home belonged to the late Audrey L. Sanders. In December 2021 Sanders sold the property to a woman named Carla Sanders, but nuisance complaints continued to pile up with city building inspectors.

A longtime neighbor, Trish Grantham, says it’s her understanding that nobody has lived in the house since the 1980s. Records show complaints about the property began piling up in 1992. Meanwhile, the house deteriorated. Even as speculators moved into the neighborhood, flipping houses like pancakes.

Property tax records show that the Sanders family has paid just enough tax to keep Multnomah County from seizing the house via foreclosure.

Comment:

The Sanders family seems to have abundant patience, paying the $2,290-plus tax levy, slowly creeping up year after year. But they may lose patience if LVT were in effect and she received a bill over $6,000, an increase of 268 percent.

If “speculators” are combing the neighborhood for houses to flip, they might open their eyes to the potential advantage they would receive if they targeted the vacant and neglected properties like the ghost houses we’ve seen. However, that eye-opener will occur after a land value tax is adopted. If it does pass through the Oregon state legislature and become a local option in Multnomah County, the pursuit of neighborhood upgrading can’t be called speculation; it’s holding onto unimproved lots that is.

It’s time to reform Oregon’s property tax system: Repeal Measures 5 and 50, and replace it with LVT based on real market assessments.

Notes:

For the 2017-18 tax year the overall Multnomah County MAV mill rate was $22.82 per $1,000 MAV. Reverting to RMV assessments lowers the mill rate to $10.32 in order to reach revenue neutrality. To illustrate the tax shift effects of changing from the MAV taxation regime to a split-rate LVT, 90% of the total RMV rate is applied to RMV land assessments and 10% to improvements. This is calculated at $23.50 on land and $2.61 on improvements.

Tom Gihring, Research Director

Common Ground, OR/WA

commongroundorwa.org