Prosper Australia

November 2022

Land Tax

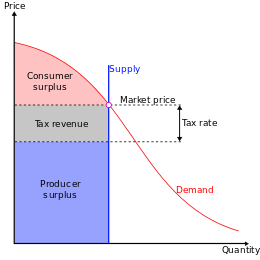

A supply and demand diagram showing the effects of land value taxation. As the supply of land is fixed, the burden of the tax falls entirely on the landowner. There is no change in the rental price and quantity transacted, and no deadweight loss.

Land tax is a payment for the services to a location. Some locations have better amenities in terms of public transport, roads and libraries. Other locations are more convenient, some more beautiful. These are all factors that influence how much we pay for living in an area. Note how landholders provide no productive service to receive these unearned incomes. A land tax is a simple way to recognise these benefits and repay society for the privilege of living there.

Over hundreds if not thousands of years, land tax has been understood as the fairest and most efficient tax available. Ask these three questions. Who created the earth? Who should profit from it? How should we finance government?

A land tax ensures those who live in the best locations pay a little more than the person near the quarry. This offsets jealousies, enhancing the social contract whilst curbing territorial disputes. Such a system also deters profiteering by hoarding prime locations for easy profit. A land tax set at a reasonable rate ensures land is put to its best and highest use. The revenue earned by government could be significant, and would (if taken to its logical conclusion) direct the naturally rising value of the earth towards financing government.

In its simplest form, a land tax is an annual percentage charge on the value of the land, payable by the owner. In Australian practice, it is levied at progressive rates, with exemptions.

As the graph at the top of the page indicates, land tax can’t be “passed on” to tenants in higher rents, because landlords are already charging the full market price. Such an annual charge leads to an immediate recognition by landlords to use their land as efficiently as possible. Thus the 80,000 vacant properties we typically reveal in our Speculative Vacancies report become uneconomic to hold. This provides a spur to the land market as vacant homes, poorly used land and spare bedrooms add to supply, putting downward pressure on rents.

Land taxes aren’t a cost of letting the land. It’s a cost of holding the land whether you let it or not. So you must find a tenant to cover the holding cost. And the more you need a tenant, the less you can demand in rent.

Because land tax can’t be passed on to tenants, property speculators don’t like it. So they campaign against it — by pretending that it can be passed on. Don’t fall for it.

Best Practice:

Land tax should be charged at a flat percentage rate on the prevailing land value. The land must be valued yearly and include no threshold. The Victorian land tax threshold rate increased from $85,000 to $250,000 between 2001 – 2009, allowing more of the naturally rising value of the earth – the rent – to be privatised into the bubble we now endure. Read more on Victorian housing policy reform, with many of these issues relating to other states.

The rate at which land tax is set is debatable without modelling. We would like to see a 6% rate implemented (the long-term average increase in land prices has hovered around 6%). We are confident this would reduce land prices in many areas. The resultant revenue can fund the removal of company, sales and income tax. Lower land prices alongside much lower tax compliance will inspire the biggest job creator, small business. With lower commercial rents accompanying a new demand for labour, wages increase.

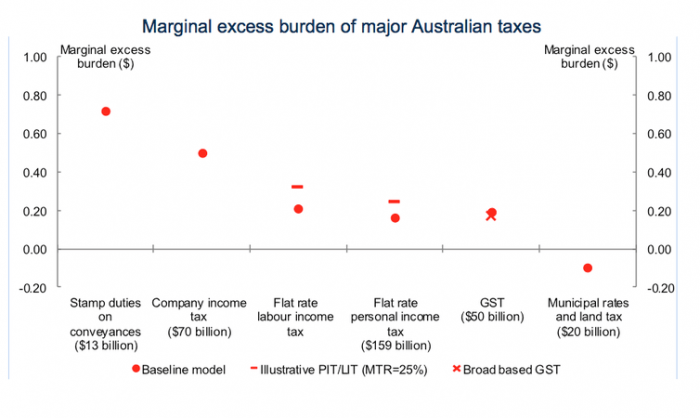

Economists’ widespread support of land taxes is largely due to their status of enjoying the lowest deadweight costs. Stamp Duties for example cost the economy some 70 cents out of every dollar raised due to the inefficiencies such a tax imposes on the economy (paperwork, the lock-in effect, extra debts etc). Land taxes actually add some 8% to the economy thanks to its dual nature of being the fairest and most efficient tax available. The following Federal Treasury graph reiterates this:

_______________________________________________

Comment:

The Georgist advocacy group Prosper Australia gives us a clear explanation of the land value tax. A few points for emphasis:

Land value is location value. Access to public amenities enhances the value of the land portion of a given property, independent of building value. It is just and fair that local government capture this publicly created value through the annual property tax, and leave the privately created value from building investments in the hands of the owner.

The land tax discourages landowners from holding onto vacant sites by placing the tax rate exclusively on land value, thus increasing holding costs. This opens up the land market, making more sites available for productive use. It also lowers the selling price of land, making property more affordable.

The article is critical Victoria’s land tax threshold which effectively exempts high value properties from paying the land tax. Prosper Australia has been campaigning long and hard for this state’s political leadership to adopt a universal land tax. In New South Wales the Land Tax Act has been in effect since 1956. Here, annual property tax payments are based on the land value of the purchased property. Tax rates are higher on investment properties.

The best practice described here is a “pure” land tax, which captures practically all the land rent from a typical property – the average annual increase in land value. In our terms it is a non-revenue neutral property tax, most certainly capturing more than the total annual revenue budgeted for local government spending. Thus, it has the capability of lowering or replacing other taxes – income taxes or sales taxes.

The land tax is the only tax that does not produce a “dead weight” loss – a drag on the economy. As an example: a tax on wages reduces consumer buying power, costing the economy sales receipts and jobs. Indeed, it is the fairest and most efficient of any tax.

Tom Gihring, Research Director

Common Ground – OR-WA