The New York Times

China Is Finally Trying to Fix Its Housing Crisis

After a year on the sidelines, Beijing this week took steps to get hundreds of billions of dollars into the hands of the country’s flailing real estate developers.

By Keith Bradsher Nov. 25, 2022

Excerpts:

More than a year after one of China’s biggest real estate developers began to collapse, trouble has rippled through cities across the country. Dozens of other developers have also missed debt payments, the sale of new homes has plunged and construction cranes have come to a standstill at many sites.

Real estate development plays an outsize role in China’s economy, representing about a quarter of economic output and a quarter of its bank loans. Housing represents at least three-fifths of household assets in China, and many Chinese regard apartments as the only reliable way to build wealth.

China’s cabinet called late Wednesday for banks, most of which are state-owned, to lend more money for the completion of unfinished apartments, following a similar directive by regulators put out hours earlier. China’s central bank, the People’s Bank of China, and the main bank regulator codified 16 measures on the same day to make sure that developers can borrow enough money from banks and bond investors, and can defer repayment when necessary. And on Friday evening, the central bank reduced by $70 billion the money that the country’s commercial banks are together required to hold for emergencies, freeing them to lend that money instead.

An affiliate of the central bank agreed earlier this month to guarantee the repayment of new bonds issued by some of the less distressed real estate developers, in effect assuring investors it was safe to lend to the companies.

The finance ministry has enacted a tax break for people who buy a new home within a year of selling the previous one.

Acting on instructions from the cabinet and bank regulators, China’s biggest banks gave lines of credit this week to large developers. The Industrial and Commercial Bank of China announced on Thursday that it had issued lines of credit totaling $91 billion to 12 developers. Bank of Communications gave a $14 billion line of credit to Vanke, China’s biggest developer.

Yi Gang, the governor of the central bank, declared that the government was willing to use its policy tools to stabilize the country’s huge real estate sector.

In housing, the crucial issue lies in whether the government should once again tolerate people using housing investments as a way to make money, rather than simply as a place to live. Mr. Xi had proclaimed in 2016 that “housing is for shelter, not speculation,” an idea that became government policy two years ago.

Oxford Economics calculated this week that prices for newly built homes across China reached 8.5 times average household disposable income last year. In the United States, that ratio peaked at 5.8 times in 2007, before the American housing bubble burst.

Some economists say that Mr. Xi was right to address speculation, but that the policy response needs to be more carefully crafted.

“Even though the direction of the policy of ‘housing is for living not speculation’ is correct, the implementation of the policy may require fine tuning in light of market conditions,” Zhu Ning, the deputy dean of the Shanghai Advanced Institute of Finance, said.

…The China Banking and Insurance Regulatory Commission has separately told banks that they can delay collecting interest and principal payments from real estate developers for a year. That deferral allows China’s commercial banking system to avoid recording a big wave of troubled loans, which would otherwise depress profits.

The housing ministry has begun allowing local governments to dismantle their extensive limits on who can buy apartments. Many cities had discouraged out-of-town investors from buying homes until now, so as to make apartments less expensive for longtime residents.

Finally, China’s Ministry of Finance has approved a temporary tax break designed to make sure that investors keep their money in the property market. The rule says that the 20 percent tax on gains from selling real estate can be avoided if the proceeds from the sale are invested into another real estate acquisition within 12 months.

The tax break, which resembles the so-called Section 1031 tax provision for real estate investors in the United States, expires at the end of next year. The goal is to encourage people sitting on large gains in the value of their homes to trade up to newer and larger apartments. That might help revive at least part of China’s huge construction industry.

Li You contributed research.

________________________________________

Comment:

Beginning in the 1990s, China’s rapidly growing manufacturing/export economy produced a new generation of explosive and concentrated wealth. Coincidental with a rapidly growing middle class, the nation’s urban housing market had been transformed from a supplier of shelter to a source of economic gain through equity accumulation.

A new mode of thinking began to unfold – the recognition that potential economic gains could be realized from shrewd real estate investments in formerly rural land newly designated for urban use.

The pursuit of private wealth accumulation through rising land values is not unique to China. It is world-wide phenomenon. Another Asian nation, Australia, is an example: “We have just experienced one of the single largest wealth generating events in Australia’s history, with property owners reaping close to $2 trillion dollars’ worth of capital gains within two years. According to the Australian Bureau of Statistics, the value of Australia’s residential property jumped from a pre-Covid $7.1 trillion to a whopping $9.1 trillion by the end of 2021”.

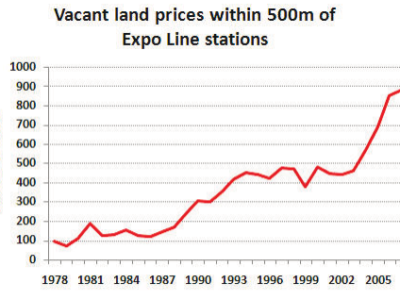

As home prices soared over the past quarter century, China’s housing market has inflated to the point where prices for newly built homes reached 8.5 times average household disposable income. Government officials want to impose tough policies to curb speculation. Reverting to its default mode, command and control measures, the Chinese government predictably approaches the problem with institutional remedies, through the banking and finance sectors. Is this the most effective means of dealing with land value inflation? Could the government switch from its top-down mode and instead adopt structural remedies that address the systemic problem of land speculation?

It is essentially the amount of speculation, not the amount of money invested in housing development that governs home prices. Land speculation leads to a tightening of the land market and further inefficiencies in the allocation of urban land resources.

A more effective way to solve the housing affordability crisis is to enable the housing market to produce housing at all income levels–by bringing down the most rapidly growing cost component of housing production, land values.

The Lincoln Institute of Land Policy based in Cambridge, Massachusetts has been making efforts to develop and implement a new property taxation system in China. The Peking University-Lincoln Institute Center for Urban Development and Land Policy (PLC) in Beijing is one of China’s leading authorities on the property tax and municipal finance. The center contributes actively to the policy agenda of the national government, and focuses primarily on the taxation of land values.

There is a way to prevent the astronomical windfalls of land speculation. Among the many effective land policy instruments that LILP has studied is the land value increment tax (LVIT), a well-known and well-tested tool for minimizing land speculation. A tax on realized unearned gains in land values, the LVIT has been applied at rates as high as 90 percent in places like Taiwan, where the tax now ranges from 40 to 60 percent.

Tom Gihring, Research Director

Common Ground – OR-WA