Transformative housing policy

Business as Usual vs. Transformative Housing Policy

by Emily Sims | May 19, 2022 | Articles, Commentary

Excerpt:

If you believe that our growing rate of homelessness is a national shame, or you’re worried that your kids will never become homeowners (or worse, never move out), then we are sorry to tell you, but whoever wins this election, these issues are unlikely to change with the government.

The policies announced by the major parties represent business-as-usual rather than transformative housing policy. The Coalition’s Super Home Buyer Scheme lets first-home buyers withdraw up to $50k of their superannuation balance for a mortgage deposit. The same amount needs to be returned to their super account, plus any capital gain, when the property is sold. The ALP’s shared equity plan involves the government “going in” with 10,000 homebuyers per year. To qualify for the scheme you must earn less than $90k per year.

THe problem with both of these schemes, as most commentators have noted, is that they put more money in the pockets of homebuyers without adding to the supply

Suggestions for expanding supply include removing ‘planning red tape,’ and incentivising councils with payments for upzoning to overcome the dreaded NIMBYs.

You’ll hear no argument from us that sharing valuable, accessible land between more people is a good plan. Yes to higher density, transit oriented development.

But these solutions miss something important. They don’t actually deliver affordable supply. They deliver new property rights in the hope that the private sector will deliver supply. But as even the industry will attest, private developers cannot keep building as prices fall

The private sector also cannot build the supply we need the most – homes affordable to those on disability or parenting payments, homes affordable on JobSeeker, and for key workers priced out by gentrification.

The phenomenal land price inflation we’ve witnessed this past 12 months has occurred in a context of negative net migration. We have less people to house than we did last year, yet prices have risen sharply. The old supply/demand equation just doesn’t stack up

House price rises are not symptomatic of a supply problem. The housing issues we face today – out of control land price inflation and diminishing access to secure housing tenure – reflect the limits of the private land market. Policies aimed at making private market housing “more accessible” tend to exacerbate price rises and marginalisation overall.

Transformative housing policy is policy that responds to the inherent structure of land markets, shaping and regulating them in ways that reduce rent-seeking for capital gains, reverse or reduce financialisation of housing, and offers non-market housing opportunities

What do we mean by this?

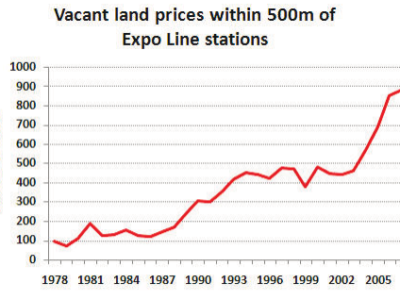

You make money out of land by dint of ownership. Economic growth, public transport investment, good HSC results at schools nearby – these increase your property’s value without any effort on your part

The boom/bust cycles we see in property markets are an inherent feature, made catastrophic by financialization, which abstracts ‘home’ into just another way to make a dime

If we are serious about supply, then we must fund non-market housing alternatives. This is not only for the proportion of Australians who require a housing subsidy, but also to protect those subsidies into the future. The aim of policy here is to get people off the land price escalator.

Non-market housing includes social housing, which almost everyone agrees needs substantial reinvestment. Non-market housing also includes things like Community Land Trusts (CLTs) and land rent schemes.

These models give first homebuyers secure tenure in a dwelling they own. They are designed to protect any subsidy from the government by regulating resale to below-market prices, and keeping the appreciating land asset in community ownership.

A shared equity scheme with these characteristics has been proposed by the Greens: 125,000 government built homes would be offered to first home buyers, with a requirement that they sell the property back to the trust at a capped rate.

Housing the population is not really a wicked problem. It’s more like vaccinating the population, or educating it. Our governments can fix the housing mess, but they must enact transformative housing policy.

____________________________________________

Comment:

As Prosper author Emily Sims notes: business as usual financing schemes simply put more money in the pockets of homebuyers without adding to the supply. And removing “red tape” by streamlining the development permitting process won’t help much at all. It is commonly assumed that rising home prices are the result of limited supply. But what is often overlooked is out of control land price inflation. The root cause? Rent seeking for capital gains.

Transformative housing policy addresses this problem directly by opposing the financialization of housing. How do we eliminate rent seeking, the capture of land price increases as “just another way to make a dime”? Here are two “vaccinations”: Jab number one, reinvest in non-market housing models such as community land trusts. The booster, reform the property tax system by changing to a land value tax. Taxing land dampens land price inflation.

Tom Gihring, Research Director

Common Ground – OR/WA