Excerpts from:

ACCIDENTAL URBANIST

September 2017 […with comments added by Common Ground – OR/WA]

Key to Education Funding: The Ground Beneath Our Feet by Sarah Kobos

If you care about Tulsa’s future, you care about public education. Having watched in awe as our state legislature convulsed to the end of yet another session, one thing is certain: education funding is obviously not the top priority of those in control at the capitol. So what can be done?

Local ad valorem property taxes contributed $157,205,576 to the total Tulsa Public Schools budget for the 2015-16 school year. Every residential and commercial property in town generates tax dollars that benefit public schools. The higher the value of the improvements on your land, the more you pay in taxes.

If that makes you cranky, remember this: public investment in roads, water lines, sewer systems, police, fire fighters, and an educated workforce give value to your private land. Public investments act like fertilizer that allow private development to grow and prosper. In return, private owners are taxed on the value of their property to help fund critical community needs. This is the handshake of community: everyone contributes and everyone benefits.

Each year, when you pay your property taxes, you are investing in the success of Tulsa and its citizens. You’re either paying it forward, or paying it back. Either way, cheers to you!

But back to our underfunded public schools…

There’s Reason for Hope. Tulsa has an ace up its sleeve that we’ve ignored for more than half a century. I’m talking about the land on which our city is built, and the fact that we have not come close to maximizing its value.

For clarification, let’s pay a visit to El Guapo’s Cantina, a Mexican restaurant that contributed to the rebirth of downtown Tulsa. They have two locations: the original one downtown, and a new restaurant in south Tulsa.

As it turns out, these two locations can teach us a lot about Tulsa Public Schools’ bottom line.

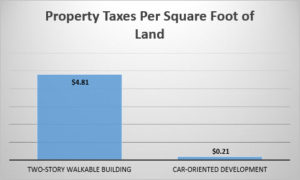

First, we have El Guapo’s downtown. This building occupies a typical 25 x 100 downtown lot, filling the entire 2,500 square foot parcel with a two-story building and a rooftop patio. It contains 5,000 square feet of floor space and pays annual property taxes of about $12,029. This means that every square foot of land associated with this modest building generates $4.81 in property taxes per year.

Next, we have El Guapo’s south Tulsa location. Built in 1979, this single-story building occupies 10,487 square feet of its 75,039 square-foot parcel. The remaining space (64,552 square feet) is dedicated to parking and landscaping. The entire parcel generates $15,899 in property tax revenue each year, which equals about $0.21 per square foot of land. To put this in perspective, El Guapo’s downtown generates approximately 23 times the amount of property taxes per square foot of land than the one located in a highly desirable south Tulsa location.

Sure, some of the difference is based on the relative value of downtown land, which can add a 40% premium over a similar parcel in the burbs. But that doesn’t explain the more than 2,000% premium on ad valorem taxes that we’re getting at the original El Guapo’s.

What really matters is how efficiently we’re using that space. Walkable Places Generate More Taxes.

Back in the day, people walked—and cities were built to support pedestrians. Blocks were smaller and parcels tended to be long and narrow, which allowed you to fit a lot of storefronts along a single block. Multi-story buildings were built up to the sidewalk, with doors and windows facing the street. All of this made it incredibly easy to walk from place to place, and people could live, work and shop within a compact area.

This development pattern was not only great for pedestrians; it was great for the city. The efficient use of land meant that it generated far more tax dollars than it cost to support. Tax revenue from these compact, multi-story buildings easily paid for the associated public services and infrastructure: roads, water, sewer, police, fire, and—yes—schools.

Development patterns changed after World War II, when a combination of government policies (everything from zoning codes written to guarantee homogeneous and low-density development to federal mortgage insurance regulations) incentivized suburban growth. As the city spread out, people lived far from where they shopped and worked, driving became a necessity, and parking lots became the suburban motif. In the suburban model, every “use” provides its own dedicated off-street parking. Major streets are designed for fast moving vehicles, which doesn’t allow for on-street parking. And the buildings themselves are designed to be accessed solely by automobile. They are built on huge parcels of land, pushed back away from the street, and separated from the sidewalk by expansive parking lots.

This is great if you want to drive, but unfortunately, this single-purpose design limits our ability to utilize modes of transportation that would allow us to maximize the value of our land—and, thus, our tax revenues.

Because El Guapo’s downtown has two floors and a rooftop balcony, it essentially occupies 300% of the land it sits on. Because the suburban site is a single-story building surrounded by parking, it occupies 14% of the available land. This makes a big difference to the tax assessor.

If we want to raise an additional $50 million dollars for Tulsa Public Schools through ad valorem taxes, we would need to add about $100 million in taxable value to the land within our school district’s boundaries. If we continue building our city like we did in south Tulsa, it would take 17 square miles of new development to increase our TPS budget by $50 million. However, it would only take ¾ of one square mile of dense, traditional, 2-story buildings to achieve the same $50 million increase.

If you add up all the empty lots and under-utilized parcels of land in Tulsa, it’s easy to envision adding ¾ of a square mile of old-fashioned, high-quality, walkable infill throughout our city. But adding 17 square miles of car-centric development??

Building places that are conducive for walking, biking and transit is not just a good idea because people love them. It’s a moral imperative. Too much asphalt dilutes the value of land, and puts our schools in the red. A return to the traditional development patterns of the past will be the key to Tulsa’s future.

If we want to solve our education budget crisis, the answer doesn’t lie solely in Oklahoma City [with the state legislature]. In fact, it’s right here in Tulsa, literally at our feet.

[Great! Now, let’s look at another perspective on the idea that the solution lies beneath our feet. Isn’t Sarah Kobos saying that excessive land consumption is the culprit? Furthermore, are not the owners of underutilized land paying far less in property taxes on a per square foot basis than owners of the kind of development we believe to be more efficient? Then, perhaps urban design is not the only solution to this problem. It’s one thing to say we want owners to build places conducive for walking, biking and transit because it’s a good idea, but another thing to bring about the vision.

Here is an opportunity to employ a non-regulatory, market-based tool to achieve what we want. Why don’t we use the property tax structure itself to incentivize the wise use of land?

A basic principle in liberal economic theory holds that legitimately created value belongs to the creator of that value. The value of land is created cumulatively by the community, and as such belongs to the community; building value is created by private capital, and as such belongs to the owner. Hence, government is justified in recapturing through property taxation what it has ‘given’. As Ms. Kobos says: “public investment gives value to your private land”.

When land values rise over time we homeowners like to call the residual “property appreciation” or “cumulative equity”; the economists call that “location rent”, a publicly derived benefit which is reflected in land value assessments. This increase can either be (i) retained by individual owners as a capitalized asset (an unearned increment), or (ii) captured by the public sector to be applied to public benefits such as additional infrastructure and public schools which further boost site values.

The conventional property tax system requires that land and buildings be assessed separately but taxed at the same rate. Inherent in the equal rate method is a set of adverse incentives that many economists and a growing number of legislators find to be counterproductive. Taxing building assessments produces a financial inducement to neglect structural improvements and delay capital investments. Under the conventional equal rate system, owners have no financial incentive to upgrade buildings or develop more intensively because a higher tax liability will result from taxing the building improvements. Did you ever wonder why absentee slumlords like the present tax system? They know the more they neglect repairs to their rental building the lower their tax liability is!

Now think about this… El Guapo’s south Tulsa location occupies 30 times more land area than its downtown site, but pays only slightly more in total property taxes. The downtown property pays nearly as much because the building contains more useable floor space. That’s the owner’s private capital that financed those improvements.

What if we converted the property tax system from an equal rate to a differential rate, shifting the property tax rate off building assessments onto land assessments? This idea has been around for over a hundred years, first proposed by 19th Century political economist Henry George.

The theory of land taxation holds that a property tax based upon land values provides an incentive to bring land into productive use; simultaneously, a reduction or abolition of taxes on site improvements would encourage more efficient land use.

So, Ms. Kobos, you identified a significant problem – the squandering of one of our most precious natural resources: land. You envision what the solution to this problem could look like – dense, transit-friendly, walkable urban settings. But If we want to raise an additional $50 million dollars for Tulsa Public Schools through ad valorem taxes, by what means should we add $100 million taxable value to the land? Through a system that extracts higher taxes from the larger scale buildings we want? As you said: “The higher the value of the improvements on your land, the more you pay in taxes.” But wait! We know that’s not the incentive owners need to invest in infill projects.

Tax land assessments at a higher rate and discourage land-holding, rent-seeking, and excessive land consumption!

The path to the walkable city ideal is a market-based tool to complement mixed-use denser zoning: LAND VALUE TAXATION.]