Sightline Institute

HOW LOW TAXES LEAD TO HIGH HOME PRICES IN VANCOUVER, BC

And how taxing land value can cool speculation and unlock affordability.

Cambie Corridor (Image from City of Vancouver)

Author: Daniel Oleksiuk May 9, 2022

Excerpts:

British Columbia home prices have soared in recent years, pricing out would-be home buyers and burdening renters while building wealth for homeowners and investors. Leaders in Vancouver and across BC must adopt tax policies to discourage real estate investment if they wish to address affordability for their constituents.

British Columbia is a far wealthier place than it was a decade ago. It has also become a prohibitively expensive place to live for more and more working families, young people, and renters of all ages, thanks to ballooning housing prices. And those high prices are inflated by a tax system that encourages speculative investment in residential property with three key policies: low property taxes, the principal residence capital gains tax exemption, and the provincial homeowner grant.

Who has profited from these speculation-friendly tax policies? The people who own most of the land in Vancouver: our neighbors and friends. In the rush to tax the bogeymen of foreigners and owners of vacant condos, a basic fact has been largely overlooked: the speculation is coming from inside the house, as homeowners who were fortunate enough to buy at the right time have quietly benefited handsomely from an unjust tax system.

These three policies enrich homeowners while driving up housing costs for everyone else. They allow private landowners to capture increased property value created by the community as a whole through its labor, public services, and contributions to the city.

Threatening the value of what is most residents’ biggest personal investment is a political challenge, to say the least. As British Columbia Premier John Horgan acknowledged, “people have equity in their homes, we need to be mindful of that.” At the same time, elected leaders in charge during a drastic loss of affordability will face political challenges from those left behind. But there’s no wiggling out of the reality that housing cannot be both affordable and a lucrative investment; prices cannot go up and down at the same time.

A TRILLION DOLLARS IN NEW PROPERTY WEALTH

The paradox of Vancouver’s housing crisis is immense gains in land wealth accompanied by poverty and desperation caused by rents and home prices surging out of control. Property values in British Columbia have almost doubled in the past decade (even when adjusted for inflation), increasing from $1.3 trillion to $2.4 trillion. Some of this increase is from new construction, but about two-thirds of it is property owners getting richer in their sleep.

The new wealth works out to $220,000 for each of BC’s 5 million residents, or $22,000 per person per year. But not every British Columbian got $220,000 richer. Many owners of detached homes in Vancouver’s central neighborhoods made millions while most renters got nothing besides steep rent increases.

VANCOUVER’S EXCEPTIONALLY LOW PROPERTY TAX RATE

The property tax rate in British Columbia’s largest city, Vancouver, has declined by more than 50 percent since 2000 and is now among the lowest in North America (see chart below). It’s only because property values have risen so much over the past two decades that the city has been able to maintain sufficient property tax revenue at ever lower tax rates.

Property taxes in other BC cities are also low (see chart below). For example, although British Columbia’s capital, Victoria, has property taxes that rank relatively high among BC municipalities, it still has the second lowest rates on the chart above, which includes cities across North America.

LOW PROPERTY TAXES BOOST PRICES AND SPECULATION

All else equal, when property taxes go down, home prices go up. In Portland, Oregon, for example, the owner of a typical million-dollar home would pay $16,000 a year in taxes, compared with just $2,900 for a home of the same value in Vancouver. That’s a difference of more than $14,000 per year, or $1,000 a month. Another way of looking at this is that, depending on the interest rate, that’s about the same as the difference in mortgage cost between a $1,000,000 home and an $800,000 home.

Smaller property tax bills mean that buyers can afford higher purchase prices, driving up home values.

Low property taxes also boost prices by encouraging speculation, because a lower tax burden reduces the cost of holding a property while owners wait for its value to rise. As Vancouver City Councilor Christine Boyle explained, Vancouver is “an appealing place for people looking to invest in housing, because the carrying cost of that investment is low, and the increases in value are high.”

Like most property taxes, Vancouver’s taxes apply to the property’s land value and to the value of the buildings or other “improvements” on that land. The land tax portion is beneficial (tax skeptic Milton Friedman called it the “least bad tax”) because it encourages maximum economic use of land. Or as Jerusalem Demsas wrote for Vox, “taxing land reduces the profit that comes from just owning a piece of property. Instead, you are incentivized to put that land to work.” In contrast, the portion of the property tax on buildings discourages their construction.

Raising the rate of just the land portion of the property tax would deliver greater affordability benefits than would raising the rate for land and improvements equally. In fact, Vancouver imposed higher rates on land than on buildings until the 1970s, when the provincial government rescinded that taxing authority. BC Assessment still records separate assessments for land and buildings, so that transitioning back toward a land value tax would be administratively simple, if not politically so.

Fortunately, even if provincial law continues to bar taxing land and buildings at different rates, in Vancouver, raising the entire property tax would still be a disincentive to speculation and land hoarding and a net positive for affordability. That’s because low-density detached houses and duplexes are built on about 80 percent of Vancouver’s residential land. These structures are usually worth a fraction of the lots they occupy (a ratio of one to fifteen is typical).

Ideally, an increase in property tax would be coupled with legalization of more homes per lot in the city’s detached house zones. That would not only offset any deterrent to building new housing caused by higher taxes but also channel the land tax incentive into the construction of modest multi-dwelling homes instead of big and pricey houses for just one family.

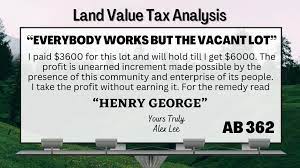

TO COOL SPECULATION, TAX LAND

For leaders looking to lower housing prices, the remedy is clear: raise the tax rate on land, not buildings. These actions would cool speculation and reduce pressure on prices. And more of the unearned property value gains the community as a whole creates would be returned to the public as tax revenue—revenue that cities could use for affordable housing, transit, and improving the lives of all residents.

The political obstacle is obvious: most homeowners have made out exceedingly well under the existing system, and they have a vested interest in keeping things the way that they are. But the political imperative for reform is just as obvious: as more and more people are priced out, the constituency demanding more equal access to the land and its profits will only grow louder.

Daniel Oleksiuk is a lawyer, writer, and organizer who has been writing and speaking about urban issues since 2016. He was on the City of Vancouver’s Renter’s Advisory Committee for four years and co-founded Abundant Housing Vancouver in 2016. Before that, he worked as a policy analyst for British Columbia’s Ministry of Housing and Social Development, and for the United Nations Development Programme’s China office. You can find him on twitter at @dannyoleksiuk.

______________________________________

Comment:

What applies to Vancouver B.C. also has relevance to the Northwestern U.S., although Oregon has a feature that compounds the inequality of the tax system.

Mr. Oleksiuk notes that the owner of a typical million-dollar home in Portland would pay $16,000 a year in taxes, compared with just $2,900 for a home of the same value in Vancouver. What accounts for that? First, we must recognize that Oregon has no sales or VAT tax. That means government funding is more dependent on the property tax, (as well as the state income tax). Secondly, due to the vagaries of Measure 50, the property tax base since 1993 is reset to the maximum assessed value (MAV), which on average in Multnomah County is only 39 percent of the real market value (RMV). Tax rates on MAVs have to be higher to reach the same revenue level RMVs would yield. In B.C., as Washington and most other states, rates are based on real values.

He also notes that smaller property tax bills mean buyers can afford higher purchase prices, driving up home values (price). This is because a lower tax is capitalized into a higher selling price. The Northwest Economic Research Center’s report: Oregon Property Tax Capitalization: Evidence from Portland, confirms this. “We find that home values are generally higher when the property taxes are relatively lower compared to other properties with similar characteristics.” The closer the MAV is to RMV, the higher the tax – and the lower the selling price. This is particularly unfair to lower income homeowners in lower value neighborhoods that have not experienced rapid growth in market value.

“Our study indicates that this [assessment] gap adds additional value to homes, exacerbating existing inequities. Property owners living in areas where RMV rises quickly relative to MAV are enjoying an increase in their property value that is not derived from property or neighborhood improvements. Instead this increase is a by-product of a property tax system separated from the market. Because these inequities are concentrated in areas where residential values have increased rapidly relative to MAV, the property tax system creates a hidden subsidy for these property owners.”

As Mr. Oleksiuk states, low property taxes boost prices by encouraging speculation because a lower tax burden reduces the cost of holding a property while owners wait for its value to rise. Under Oregon’s current equal rate tax system taxes on vacant and underutilized properties are extremely low. The capitalization effect allows a seller to extract a higher price for merely holding onto the site. Owners’ efforts had nothing to do with their newfound wealth. Left behind are renters who gain nothing from rising land values because they are not in a position to capture any of the unearned increment.

“Homeowners who were fortunate enough to buy at the right time have quietly benefited handsomely from an unjust tax system.” And here’s the takeaway: “There’s no wiggling out of the reality that housing cannot be both affordable and a lucrative investment; prices cannot go up and down at the same time.”

Tom Gihring, Research Director

Common Ground OR-WA