Thailand’s Financial Ministry is considering a Land Windfall Tax, but is also about to adopt a Land & Building Tax. What is the wisdom of each?

ABSTRACT: Thailand’s Land and Building Tax Economic and Philosophical Grounding

H. William Batt, Ph.D., Center for the Study of Economics, Philadelphia, and

Central Research Group, Albany, NY. [email protected] June 20, 2017

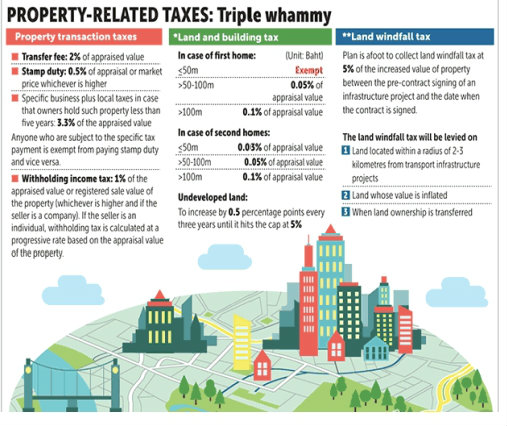

[Under Thailand’s Financial Ministry is the consideration of a Land Windfall Tax. Pending in the National Legislative Assembly is also a Land & Building Tax, similar to that which prevails here in the U.S. Thailand has followed the example of the U.K. and other Asian nations such as Singapore in adopting a Property Transaction Tax (transfer fee and stamp duty).]

The philosophical grounding of Thailand’s Land and Building Tax, now being phased in, has had little abstract discussion. But in fact each rests on very different foundations. They are both ad valorem taxes, but the tax on land is based on the flow of what economists call rental value; the tax on buildings, in contrast, is a tax on their value as stock. Stock and flow are basic differences in economic theory. Stock values have their grounding in the two factors of production, labor and capital. But that land values reflect the socially-created flow of ground rent as understood in classical economics. Each has a very different moral foundation. Taxing real property, both lands and buildings, also has profoundly destructive economic results: for its losses in economic efficiency, equity, neutrality, administrability, transparency, simplicity, and, ultimately, for its legitimacy, both for the tax itself and to the state.

It would behoove Thai government policy makers to return to an exploration of land value as flows of ground rent, which can best be recaptured in pecuniary form, even if no longer in the form of labor and goods as was once the case.

Source: Bangkok Post 22 March, 2017

Comment: The Thai government recognizes the truth of land value gains – they are windfalls that can be captured through taxation. A targeted windfall tax, limited to infrastructure projects, is a good start. Will it see the wisdom of broadening the recapture regime to include all real property?