FEDERAL RESERVE BANK OF CHICAGO

Chicago Fed Letter, No. 489, November 2023

Excerpts:

Land Value Taxes—What They Are and Where They Come From

By Elizabeth Kepner , Rick Mattoon

Changes to property tax structures, including the introduction of split-rate taxation, have been seeing increased interest from policymakers. Split-rate property taxation is rooted in the concept of land value taxation, which is an alternative to the form of property taxation used in most U.S. communities. In this Chicago Fed Letter, we explain what these alternatives to traditional property taxation are and provide some history on their implementation in the U.S.

Property taxes in the U.S. are based on the market value of a property, including land and alterations to that land (including buildings), called “improvements”. Pure land value taxes, in comparison, are taxes on the value of land, excluding any improvements to the property.

The case for land taxes dates back to eighteenth- and nineteenth-century economists and philosophers Adam Smith, David Ricardo, James Mill, and John Stuart Mill. They wrote about land taxation as a means to encourage economic development. In his influential 1880 book, Progress and Poverty, 1 Henry George cites ethical reasoning for the land value tax along with economic efficiency reasons. He argued that because land value is not decided by the owner but by the community and the surrounding area, land value taxes should go to benefit that community (Dye and England, 2009). Under a pure land value tax system, an empty lot of land would be taxed at the same rate as neighboring, equivalent parcels with homes on them. Removing a tax on improvements removes the disincentive to develop improvements on land.

Split-rate tax systems have separate tax rates on land and improvements and can be thought of as a combination of typical property taxes and a land value tax. For any property, land is taxed at a higher rate and the buildings and improvements on the land taxed at a lower rate. This tax policy may be seen as a way to encourage development of land and reduce the burden of property taxes for homeowners.

Economic reasoning behind land value taxes

There are several basic reasons why taxing land (or increasing the rate of land taxation compared to improvements) might be fiscally beneficial for a city. A typical good has an upward sloping supply curve, which means that as the price of a good increases, firms are more willing to produce that good and therefore increase their quantity produced. In this case, taxation creates a market inefficiency called a deadweight loss. These inefficiencies can discourage investments in that market and encourage people to invest in a lower-tax municipality. People cannot, however, move their land.

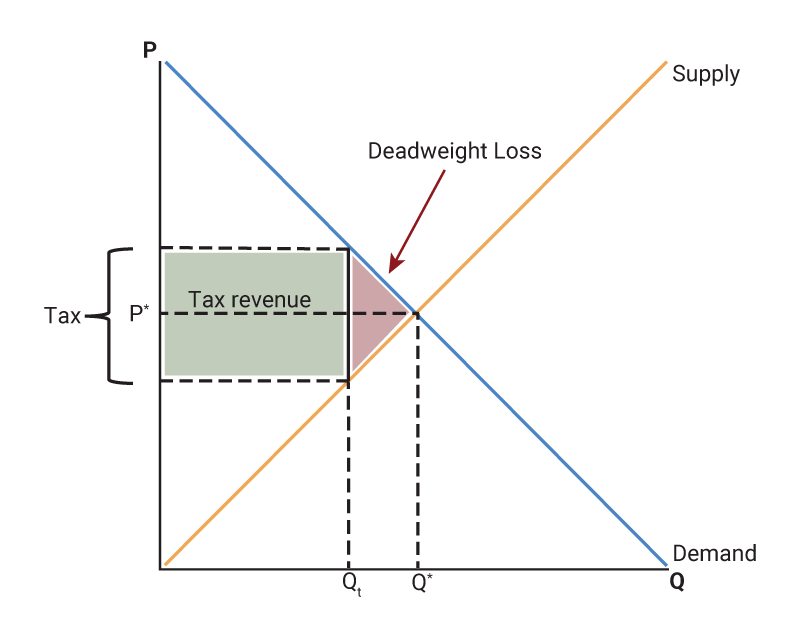

Figure 1, panel A, depicts a classic supply and demand model of a taxed good with upward sloping supply curve and downward sloping demand. The tax increases the price that people pay for the good (the market-clearing price plus the tax) and decreases the quantity consumed. The tax also decreases the price received by producers for the good and decreases the quantity produced. The deadweight loss triangle is the value lost by consumers and suppliers as the market is distorted by a tax and the quantity of the good that is produced is reduced.

- Supply and demand models: Typical good versus land

A. Supply and demand of a taxed good

A. Supply and demand of a taxed good

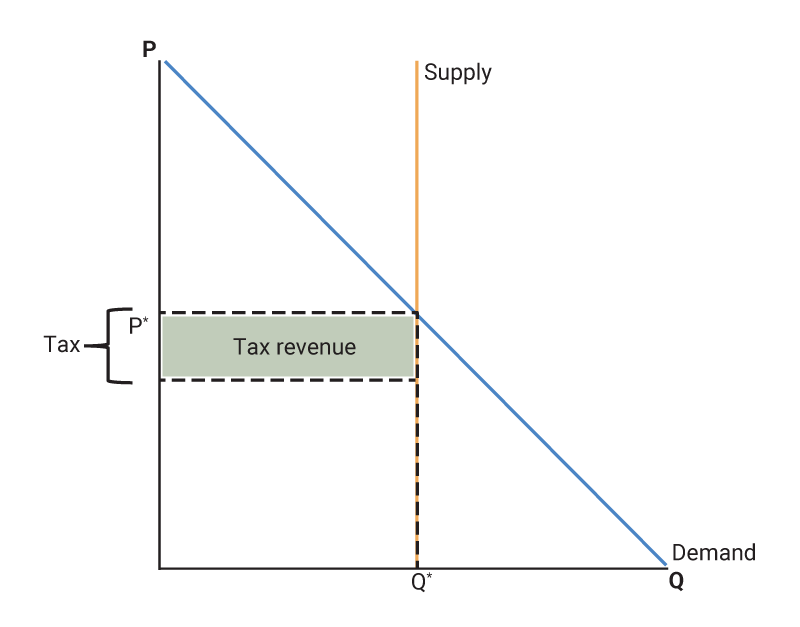

B. Supply and demand for land

B. Supply and demand for land

Source: Chicago Fed staff illustration.

Figure 1, panel B, depicts a supply and demand model for land, which has fixed, perfectly inelastic supply whereby the supply of land does not change with the price of land. When a pure land value tax is implemented, that tax is considered neutral; it does not create a deadweight loss. This is because when supply is perfectly inelastic, the incidence of the tax falls entirely on the supplier of the good with no change in equilibrium output. In the case of land, the owner receives lower rents on the land, but the quantity supplied is not reduced.

A split-rate tax, where there is a partial tax on improvements, on the other hand, would create a deadweight loss. Split-rate taxes would reduce the incentives for making improvements, but by less than a traditional property tax. The split-rate tax is designed to encourage development by lowering (compared to a traditional property tax) the tax rate on improvements.

Because pure land value taxes do not create any deadweight loss, revenue from that tax might be large enough to replace the typical property tax, along with other forms of taxes for a municipality, while remaining revenue neutral. In the example of one U.S. city, introducing split-rate taxes allowed the city to avoid other forms of tax increases, encouraging development.2

Advocates of a current split-rate tax proposal in Detroit argue that introducing it would provide tax relief to homeowners that would exceed that provided by existing property tax assistance programs. In a comprehensive study of land value taxes, Kumhof et al. 2021) illustrate the modern literature behind land taxes, as well as some of the conditions required for a useful land tax.

U.S. experience with split-rate/land value taxation

Among U.S. states, Pennsylvania has the longest history of implementing split-rate property taxation. The split-rate structure (adopted in that state in 1913) was a compromise between a pure property tax and a pure land value tax that was seen as being more familiar and potentially less confusing to taxpayers as it maintained elements of traditional property taxes. In theory, a split-rate tax incentivizes construction and improvements relative to undeveloped land through a favorable tax cost. However, the ability of split-rate taxation to cause higher levels of development will depend on all other factors (market location and conditions, access to labor, impact of other taxes, and business climate) being equal at a competitive location that has a traditional property tax.

Evidence of the possible impact of split-rate taxation on building permits was identified in Cord (1983). 3 This paper analyzed the experience of three neighboring cities in Pennsylvania—McKeesport, Clairton, and Duquesne—which were all suffering from declines in the steel industry. McKeesport adopted a split-rate tax structure in 1980. In the three years before and after 1980, McKeesport saw a 36% gain in its average annual value of building permits ($1.716 million to $2.333 million), while Clairton saw a decline of –30% and Duquesne had a fall of –14%.

Advocates for land value or split-rate taxation also argue that it can influence business formation decisions, according to Hanson (2022). During 1994–2017, four Pennsylvania cities adopted a split-rate system and five reverted to a conventional property tax. This policy change provided a case study that allowed for a series of technical assessments of the impact of a split-rate tax model. The three principal findings regarding business formation were:

- There was a statistically meaningful and immediate increase in the number of business establishments in municipalities that switched to a split-rate system. This was associated with a gain of 60 to 107 business establishments.

- This gain in establishments was followed by a slow and significant decrease in establishments over time, but the level of establishments remaining still exceeded that for the pre-implementation period. In subsequent years after implementation of the split-rate tax regime, the decline in business establishments was between 3.3% and 5.5%.

- Changing the tax rate to raise the rate on land versus structures does not seem to have influenced business establishment formation.

The study also identifies that the impacts varied by industry type. The greatest positive effects occurred in the wholesale, retail, construction, manufacturing, and transportation sectors. The most negative impacts were in services and finance, insurance, and real estate.

Evidence from Pittsburgh

Pittsburgh was the largest city to adopt a split-rate tax, and its tax structure has been studied for more than a century. Pittsburgh first adopted a citywide split-rate tax in 1913. Between 1913 and 2001, the ratio of the tax on land versus structures was 5.77. A countywide reassessment in 2001 drastically increased assessed land values, which led to resident disapproval. Pittsburgh reverted to a single-rate property tax.

However, city business leaders felt that a land value or split-rate tax could be an effective development incentive for the central business district. In response, the Pittsburgh Business Improvement District instituted a land value tax as a surcharge on top of the single-rate property tax from 1997 to 2016.

Oates and Schwab (1997) studied Pittsburgh’s land tax and found that while the impacts were difficult to fully isolate, the land tax structure had a significant role in spurring commercial investment in downtown Pittsburgh. They argue that land value taxes are intended to encourage economic decisions in favor of development relative to a single-rate tax by lowering the tax rate on improvements. However, they qualify their findings with several important other factors, including:

- The central business district of Pittsburgh had extraordinarily low vacancy rates when the tax was adopted, suggesting that considerable excess demand for commercial property already existed.

- The city had embarked on a major commercial development program (called Renaissance 2) during this period.

Despite these potentially offsetting factors, the authors found that Pittsburgh experienced a higher level of construction than similar-sized cities in the Midwest that also had low vacancy rates. The percentage change in the average annual value of building permits between 1960–79 and 1980–89 was 70.43% for Pittsburgh, compared to an average decline of –14.42% for a 15-city sample of midwestern cities. In Pittsburgh, the average construction value (in 1982 dollars) for building permits went from $181.7 million to $309.2 million.

An important question raised by the authors is what would have happened if Pittsburgh had raised other taxes to meet fiscal needs in the event that the land value tax was rejected? An alternative, such as a wage tax, might have discouraged investment relative to the positive incentives under the land tax. For example, Inman (1992) estimated that an increase in Philadelphia’s wage tax from 5% to 6% would result in the loss of 80,000 jobs, or 12.7% of existing employment levels.4

Conclusion

Split-rate or land value taxation provides an alternative to traditional property taxation. Economists have long suggested that land value taxation is more efficient and potentially better able to encourage economic development. However, examples of U.S. communities adopting land value taxation have been relatively scarce. In part, this may reflect the difficulty of identifying the magnitude of the impact of such a tax policy change.

Notes

1 Henry George, 1880, Progress and Poverty: An Inquiry into the Cause of Industrial Depressions, and of Increase of Want with Increase of Wealth. The Remedy, New York: D. Appleton and Company, available online.

2 Wallace E. Oates and Robert M. Schwab, 1997, “The impact of urban land taxation: The Pittsburgh experience,” National Tax Journal, Vol. 50, No. 1, March, pp. 1–21. Crossref

3 Steven B. Cord, 1983, “Taxing land more than buildings: The record in Pennsylvania,” Proceedings of the Academy of Political Science, Vol. 35, No. 1, pp. 172–179. Crossref

4 It should be noted that the tax structures of Philadelphia and Pittsburgh are different, so it is difficult to extrapolate that a similar level of impact would occur in Pittsburgh through an increase in the wage tax. In Philadelphia, the wage tax is a commuter tax with suburban communities choosing not to tax wages. In Pittsburgh, suburban communities also have wage taxes (based on place of residence), so that the incentive to move employment in response to a wage tax differential is muted.