Mayors pitch new real-estate tax as another tool against the housing crisis

Katie Lannan October 11, 2023

Excerpts

In Cambridge [Massachusetts], where median rents top $3,400 for a two-bedroom, residents regularly name affordable housing as their top concern on an annual survey. Amherst’s rental market is strained by a growing number of college students living off-campus. A family hoping to buy a house in Concord would need an annual income of $300,000 to afford the median list price of $1.5 million.

Local officials and advocates presented those facts and figures to state lawmakers Wednesday as they asked the Legislature to give them another tool in the fight against the continual squeeze of high and rising home prices: the ability to levy a new tax on certain high-value real estate sales and put those proceeds toward affordable housing.

Lawmakers on the Revenue Committee heard testimony on bills that would let 10 individual communities — Concord, Arlington, Chatham, Provincetown, Amherst, Truro, Somerville, Cambridge, Wellfleet and Boston — impose their own local-level real-estate transfer taxes, along with a separate bill that would change state law to allow cities and towns to take that step without first seeking permission from the Legislature and governor.

Many of those municipalities have been trying to put a transfer tax in place for years. Concord Town Meeting voted to approve a transfer fee plan in both 2019 and 2023, and Somerville Mayor Katjana Ballantyne said she supported transfer fees when they first came before her as a city councilor in 2018.

“Currently, the median rent for a two-bedroom apartment in Somerville has soared to $3,000 a month. These escalating housing costs have been highly destabilizing for many vulnerable members in our community.

The idea, however, has not gained traction with the Legislature’s Democratic leadership in recent years. It’s also opposed by some real estate industry groups, including the Greater Boston Real Estate Board. In written testimony to the committee, the GBREB argued that transfer taxes would add new costs to home sales and represent an unstable revenue source. “A new sales tax on homes and real [estate] simply limits the incentive to invest in new multifamily housing, slows the production of new supply and only exacerbates the challenge of housing affordability.”

The tax proposals vary by community. Under Boston’s home-rule petition, property sales for $2 million or less would be exempt. Above that threshold, the city would apply a 2% fee on the portion of the price above $2 million. Mayor Michelle Wu said that, in 2021, the fee would have generated up to $100 million in revenue for housing affordability and production efforts.

Backers of transfer tax bills hope they’ll have an ally in Gov. Maura Healey. While former Gov. Charlie Baker didn’t support the idea, Healey campaigned on a platform that pledged to “empower communities to enact local policies that best address their own, unique housing challenges.”

Comment:

Real estate transfer taxes levied upon settlement of a property purchase and paid by the buyer, are known in Commonwealth countries as stamp duties. In Australia stamp duties are levied by the Australian states on property purchases of land (both freehold and leasehold) and buildings. The amount of duty depends on the value of the property, with more expensive properties attracting higher rates of stamp duty. The purpose is to generate revenue for state and territory government budgets, which can then be used for public sector projects, such as health, transport, education, or infrastructure.

But stamp duties are controversial in Australia, for similar reasons as stated by Massachusetts Democratic leadership and the GBREB. It is an unstable source of revenue, and slows the production of new housing units.

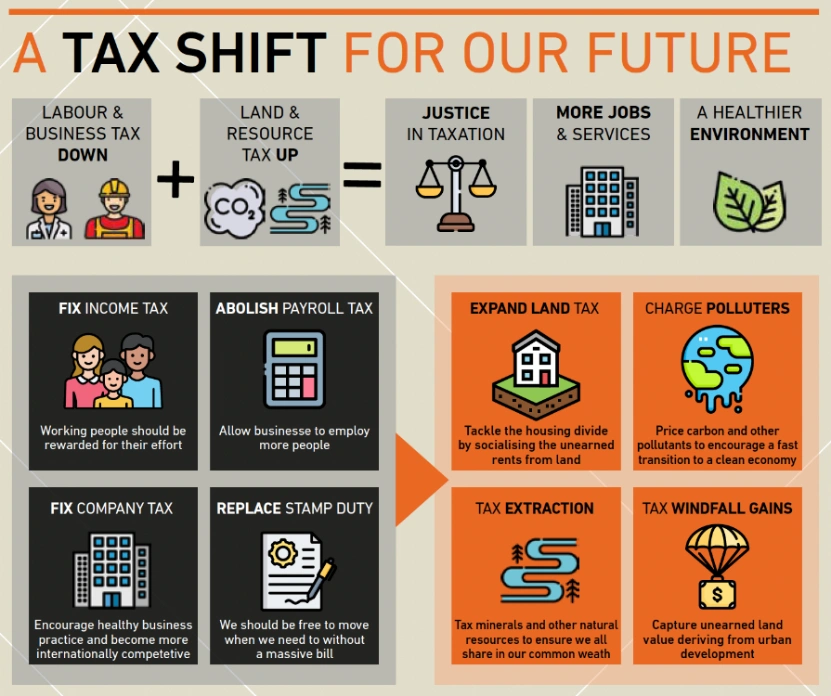

Prosper Australia advocates for replacing state stamp duties with land taxes as a worthwhile reform. The Land value tax (LVT) is the obvious replacement of a stamp duty, providing a more stable revenue alternative. LVT is universal, recurrent, and taxes economic rent. Land has no production cost, therefore is simply a measure of the value it provides. Those benefits are socially, not privately, provided. They are generated by public infrastructure and services, land use regulations, community growth, proximity to markets, and natural amenities. LVT is rather like a ‘user charge’ for the benefits society provides the landowner.

LVT is broad-based, administratively simple, and economically efficient, LVT finds favour with economists and progressives alike. It is “the least bad tax”, as economist Milton Friedman claims.

Real estate transfer taxes are in effect in several states throughout the United States. Oregon is one of the 13 states that don’t require buyers or sellers to pay transfer taxes when a property exchanges hands, with one exception – Washington County.

The rest of the state, however, is exempt after the Oregon Real Estate Transfer Tax Amendment, Measure 79, also known as Initiative 5 was passed. Oregon prohibited real estate transfer taxes throughout the state, excluding Washington County, where the rate of $1 per every $1,000 on the purchase price of the home has brought in millions of dollars every year.

The increased revenue Washington County taxes has prompted the Oregon Legislature to introduce bills restoring the transfer tax across the state. They did not pass in 2020, but taxing property in this way is still seductive.

Our legislators should resist this temptation, and instead follow the lead of Prosper Australia. Reform Oregon’s current broken property tax by taxing land rent, not real estate transfers. Adopt the land value tax. Hopefully Massachusetts legislators will do the same.

Tom Gihring, Research Director

Common Ground, OR/WA