WILLAMETTE WEEK

What East Portland Wants

The most neglected part of the city is getting a louder voice. Its voters have plenty to say.

By Eliza Aronson, Veronica Bianco, and Lin Lin Hutchinson

July 17, 2024

Excerpts:

Heading east toward 82nd Avenue, Portlandia fades away. Like many lower-rent neighborhoods, East Portland is a giving tree. And where else does Portland renew itself with immigrants from Africa, Asia, Latin America and Slavic Europe, whose rich cultures and grit keep Portland vibrant?

Thankfully, the place is about to get some overdue attention. In August, the sprawling region got a new name: District 1. Amplifying the voices of East Portland was one of the main reasons for the overhaul. If East Portland’s new representatives prove competent, they could bring real change when they take office in January.

For all its (underappreciated) charms, East Portland can be a tough place to live. You’re more likely to get shot in East Portland than you are anywhere else in the city, save for a few mean streets in downtown Portland. Cars kill more pedestrians out here, as does unshaded summer heat.

The conditions are a direct result of neglect, as WW has reported in stories dating back more than a decade (“The Other Portland,” Oct. 12, 2011). City leaders left East Portland’s needs at the bottom of their to-do list. Neighborhoods east of 82nd Avenue have more unpaved roads than any other part of the city. Tit-for-tat gang shootings often go unsolved. Last year, 30 Douglas fir, Japanese maple and redwood saplings planted in Mill Park died because the Portland Bureau of Transportation simply didn’t water them. Income per capita is lower across East Portland. The median income in District 1 is $61,000, compared with $90,000 in District 2 (North-Northeast), $84,000 in District 3 (Southeast), and $94,000 in District 4 (westside).

What do East Portland voters want from their new-fangled, state-of-the-art City Council?

To answer that question, we spent two weeks roaming the streets of Argay Terrace, Mill Park, Hazelwood, Foster-Powell and Lents.

Heavenly Hedenberg lived in the Lents neighborhood for 15 years. Her modest plea to the future City Council: “Figure out the homelessness and fix the roads.” Olga Scheglyuk’s ground-floor apartment is about 400 feet from the Portland Police Bureau’s East Precinct

Even so, the neighborhood is more blighted now than it was seven years ago, when she moved here. Crime, drugs and homelessness are all worse, she says. What would she like from the new city councilors in East Portland? A greater sense of security. More than anything, she’d just like to feel safe in her home.

Kate Giambrone, a graphic designer from Pittsfield, Mass., has lived in the Lents neighborhood for a decade. Giambrone’s biggest concerns are affordable housing and safe streets. Too often, she sees cars speeding down residential streets at ridiculous speeds.

“There aren’t any sidewalks past 103rd Avenue,” she says. “You just walk on the side of the road. Good luck, I guess.” Another thing that would make life better in East Portland? More foliage. East Portland has less than half the tree cover that the west side of the city does.

Jenny Stine watches tenants of the Lafayette Court Apartments, the low-income building she manages, come and go in the parking lot, enjoying the cooler summer evening after a scorching day. Like many other District 1 residents, Stine faces daily dilemmas with homelessness and drug use. She sees housing insecurity up close. “There are those living in cars or living with families,” she says, “that are so well hidden that they’re not getting the attention.”

Sergi Zalutskiy just last year moved to Southeast Powell Boulevard, where he rents a house with his wife and kids. Homelessness and crime are Zalutskiy’s big concerns. He drives every day now, on East Portland’s pot-holed roads. Like so many stretches, a side street near him isn’t paved. “I feel like I’m in a Third World country because it’s so bumpy,” he says.

Rita McCarty’s apartment living room in the Argay Terrace neighborhood is filled with teddy bears, twin pictures of Presidents Barack Obama and Joe Biden, and bird magnets.

McCarty’s biggest concern, at least in recent years, has been gun violence. She regularly hears gunshots these days

Pastor Melke Tadesse has been preaching Sunday sermons to the congregation for about a year. Like all Christian faiths, the Ethiopian church follows Christ’s teachings about the poor: They are blessed, and the kingdom of God belongs to them. But sometimes East Portland tests Tadesse’s patience. Homeless people, he says, break the church’s windows, sneak in to use the restroom, and often sleep in the doorways. He understands their plight, but he also has a flock to protect. Median household income in Parkrose jumped 34% to $60,278 in 2022 from $45,128 in 2017, in line with gains around the metro area, but people still feel strapped, Tadesse says. Groceries are more expensive than they were before the pandemic, and rents have risen.

Megan Dart-McLean, 45, moved to Lents five years ago because she could afford to buy a house there with help from the city’s Down Payment Assistance Loan program. Like many East Portlanders, she worries about speeding drivers. Crash data supports her concern. In 2023, the traffic fatality rate in East Portland was 15 per 100,000 residents, compared with 9 per 100,000 in the rest of the city. About a third of the deaths were pedestrians. She’d like the city’s leaders to police the RVs and add some sidewalks.

____________________________________________

Comment:

East Portland residents, like everywhere else, report what they see in their daily lives. But often, there are concerns that are equally pressing but not so visible, like unfair financial burdens underlying Oregon’s property tax system. District 1 councilors need to focus their attention on the stealth “frankentax”.

Believe me, we at Common Ground OR/WA have raised this issue time and again, and have thoroughly documented the inequities of Measures 5 and 50 that have plagued the tax system since the early 1990s. East Portland neighborhoods have been particularly hammered because property values have risen more slowly than in other areas of Portland such as Inner Northeast.

Here’s an example of popular reporting on this same issue from nearly ten years ago:

OREGONLIVE

The Oregonian Business

Tax breaks for gentrifiers: How a 1990s property tax revolt has skewed the Portland-area tax burden

Updated Apr 22, 2019; Posted Sep 11, 2015

By Elliot Njus | The Oregonian/OregonLive Excerpts:

___________________________________________________________

Tom Lewis says his east Portland neighbors have voted time and again with the rest of the city to raise taxes, but they’ve seen little of that money come back in the form of improved schools, transportation and parks.

That’s bad enough. But it also turns out that Lewis and his neighbors are paying more than their fair share of those taxes compared to other parts of the city. “We’ve got ‘sucker’ written on our forehead,” he says. Last year, Lewis’ property taxes came out to $15.74 per $1,000 in value. Across town, a similar house just off trendier Northeast Alberta Street is worth twice as much, but its owners paid just $4.59 per $1,000 in value.

Oregon’s property tax system has dramatically distorted the tax burden in the Portland area, an analysis by The Oregonian/OregonLive found, pushing responsibility for basic government services off the backs of one set of homeowners and onto others.

Swaths of North, Northeast and Southeast Portland are getting tax breaks while homeowners in east Portland and Southwest Portland pick up the bill. In Clackamas County, many Lake Oswego residents see major savings while 58 percent of the county’s homeowners pay more than their share based on home values.

The culprit: ballot measures voters approved in the mid-1990s to slow soaring property tax bills. That’s when Oregonians moved away from the traditional standard of taxation in which the amount you pay depends on how much your home is worth.

Homeowners like Lewis and his east Portland neighbors now make up a solid majority of taxpayers in the metro area. If the total amount collected stayed the same but taxes were once again tied to market values, 57 percent of homeowners in the Portland area would see their bills drop, according to the analysis.

In some cases, residents least able to shoulder the extra burden are being forced to carry more. The median household income in Lewis’ east Portland ZIP code is $35,970, compared to $61,962 near the house off Alberta. “It’s not fair and it’s not equitable in terms of what we get for our tax dollars,” said Arlene Kimura, an east Portland neighborhood activist. “We’re not even close in proportion to some of the more affluent parts of the city.”

Oregon’s system has created great inequities, concentrating benefits in gentrifying neighborhoods that have seen fast-rising home values. Other parts of the metro area have seen their relative tax burdens increase. “We’re pricing people out,” said Kimura, “It’s hard enough for people to come up with down payments and all this stuff. And then to come up with a $2,000 tax bill? And somebody else’s property tax is basically 50 percent of that?”

At least one analysis showed that the inequity in property taxes added fuel to gentrification. The Northwest Economic Research Center at Portland State University found that in Portland, properties getting a tax benefit tend to sell for a premium: a dollar of tax savings can amount to an average increase of $33 in sales price.

___________________

More recently, Common Ground OR/WA commissioned a follow-up study, also by the Northwest Economic Research Center, evaluating Oregon’s broken property tax system. The study’s data revealed that the average property tax bill for homeowners in outer southeast Portland comes to $12.17 per $1,000 in value; the same measure for inner northeast residences is $7.29 per $1,000 in real market value.

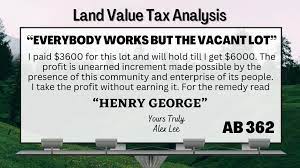

The NERC study didn’t just document what we know are inequities in the tax system; it examined a potential solution: a land value tax (LVT). The researchers concluded that LVT as an alternative to the current system is not only more equitable, but also provides a tax incentive to invest in building improvements. This is accomplished through a return to real market value assessments and differential tax rates on land and buildings. A high tax on land values incentivizes land holders to release their sites for development; a low tax on building values incentivizes developers to build more housing. The study shows that the multifamily housing type receives the greatest tax advantage because of the high ratio of building value to land value.

That should be good news to the pro-housing organization Portland Neighbors Welcome and the candidates running for city council election this November. Here’s an update from PNW from Sunday, August 18, 2024:

“Our team developed, circulated, collected, and scored a questionnaire for all candidates. Fully 41 candidates responded, and get this: zero of them expressed opposition to our Inner Eastside for All campaign to allow apartments from 12th to 60th and Fremont to Powell. The vast majority supported the concept outright.”

Here’s a final word from Rick Rybeck, Director of Just Economics:

If owners construct or improve buildings, we penalize them with higher taxes. If owners allow buildings to deteriorate, we reward them with lower taxes. And the owners of vacant lots pay much less than neighbors with buildings, even though it costs communities about the same to provide streets, sidewalks and other infrastructure in front of similar-sized lots regardless of whether they are developed or vacant.

Fortunately, some communities remedy the upside-down property tax by reducing the tax rate applied to privately-created building values while increasing the rate applied to publicly-created land values. The lower tax on buildings makes them cheaper to construct, improve and maintain over time. Surprisingly, the higher rate applied to land values helps keep land prices down by reducing profits from land speculation. Thus, without new spending or loss of revenue, this Tax Shift can make both buildings and land more affordable.

See, “Want Affordable Housing? Look to the Land!” at https://drive.google.com/file/d/1rvU0CePqi6pateHT_kByNWOzZV8feP8p/view

Tom Gihring, Research Director

Common Ground, OR/WA